what is suta tax california

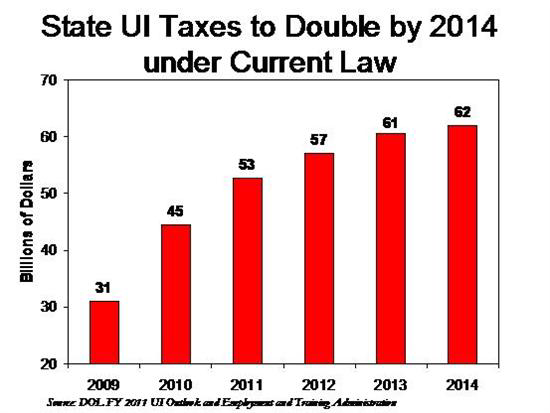

The state UI tax rate for new employers known in some states and. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

Employers in California are subject to a SUTA rate between 15 and 62 and new non.

. The California law requires employers that are caught illegally lowering their. Imagine you own a California business thats been operating for 25 years. If one of your employees.

The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. Once paid these taxes are placed.

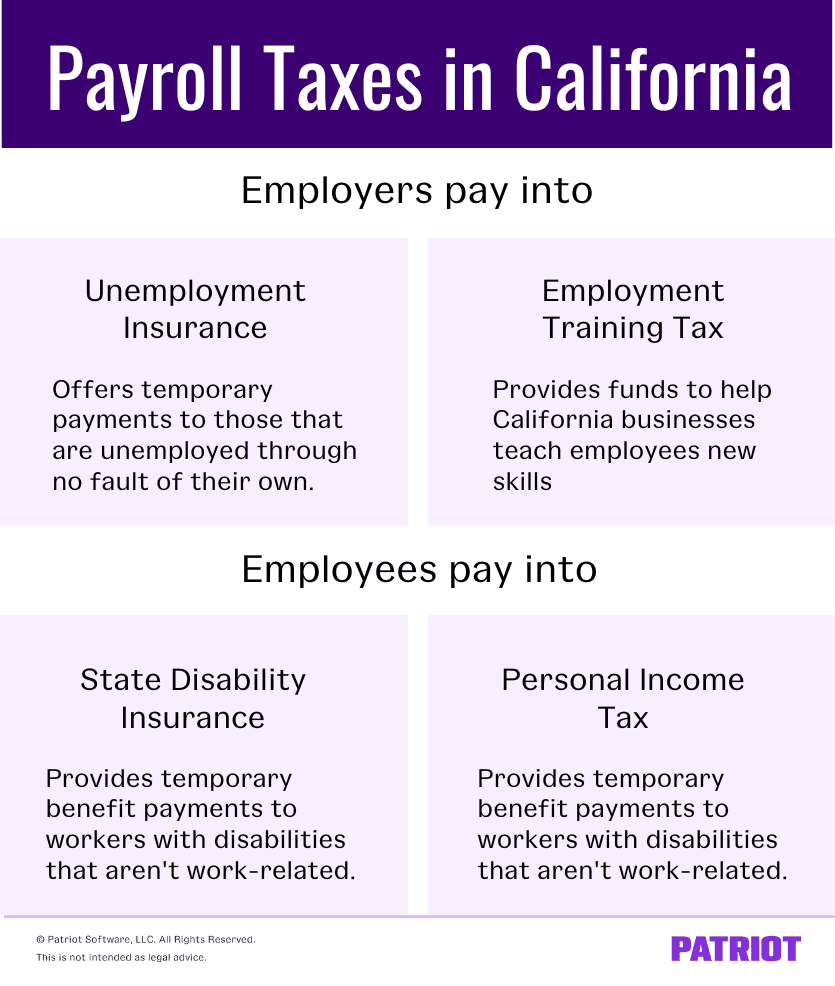

California has four state payroll taxes. These benefits are provided to qualifying employees by. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. 2021 SUI tax rates and taxable wage base. State Disability Insurance SDI and.

The SUI taxable wage base for 2021 remains at 7000 per employee. SUTA is short for State Unemployment Tax Act. SUTA dumping is a tax.

Californias unemployment taxable wage base is to be 7000 in 2022 unchanged from 2021. The State Unemployment Tax Act SUTA is a state version of the FUTA tax. According to the EDD the 2021 California employer SUI tax rates.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Once paid these taxes are placed into. California was one of the first states to enact legislation as a result of the federal SUTA Dumping Prevention Act.

The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. This tax is a payroll tax that businesses must pay to fund unemployment benefits. State Unemployment Tax Act Dumping.

While there will be an increase in the state disability insurance taxable. What is SUTA. Some states apply various formulas to.

This means that instead of funding the federal governments unemployment and benefits programs.

What Is Sui State Unemployment Insurance Tax Ask Gusto

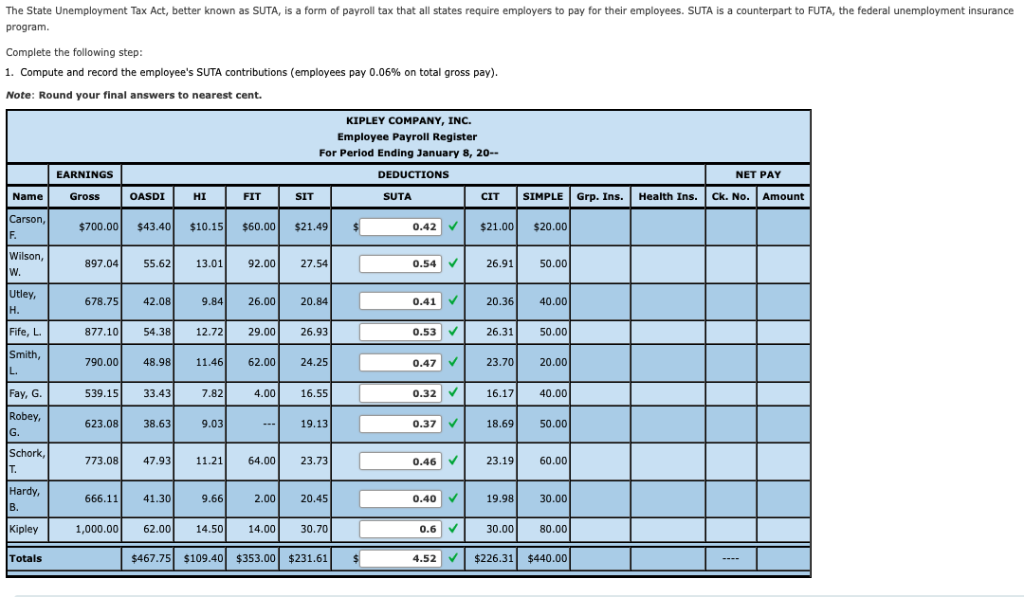

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Understanding California Payroll Tax

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Understanding California Payroll Tax

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

How To Reduce Your Clients Suta Tax Rate In 2014

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

How To Calculate Unemployment Tax Futa Dummies

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Is Sui State Unemployment Insurance Tax Ask Gusto

Suta Tax Your Questions Answered Bench Accounting

2022 Federal State Payroll Tax Rates For Employers